Are They Coming for Our Classics? – The Chancellor’s Bonkers Plan to Tax Heritage!

Rumour has it the Chancellor, Rachel Reeves, is preparing to scrap the 40-year tax exemption for classic cars – and if true, it could be one of the daftest economic moves in decades. Because make no mistake – if this goes ahead, you won’t just be taxing old motors. You’ll be taxing passion, history, and an £18-billion-a-year industry that already contributes around £3 billion in taxes annually to the Treasury.

That’s right. The same government that loves to preach about “protecting heritage” might soon be taxing it to death.

The Rumour That Shook the Classic World

According to several reports, the Chancellor is considering removing the 40-year rolling Vehicle Excise Duty (VED) exemption – the rule that means once your car turns 40, it becomes “historic” and no longer pays road tax.

Over 300,000 classic vehicles currently benefit from this system – from Series Land Rovers and Triumphs to the first Ford Cortinas and Morris Minors. Under the new proposal, all of them could be slapped with an annual road-tax bill.

The Treasury claims this could generate £100 million a year in extra revenue. Sounds like a tidy sum – until you realise the sector already pays 30 times that in other taxes.

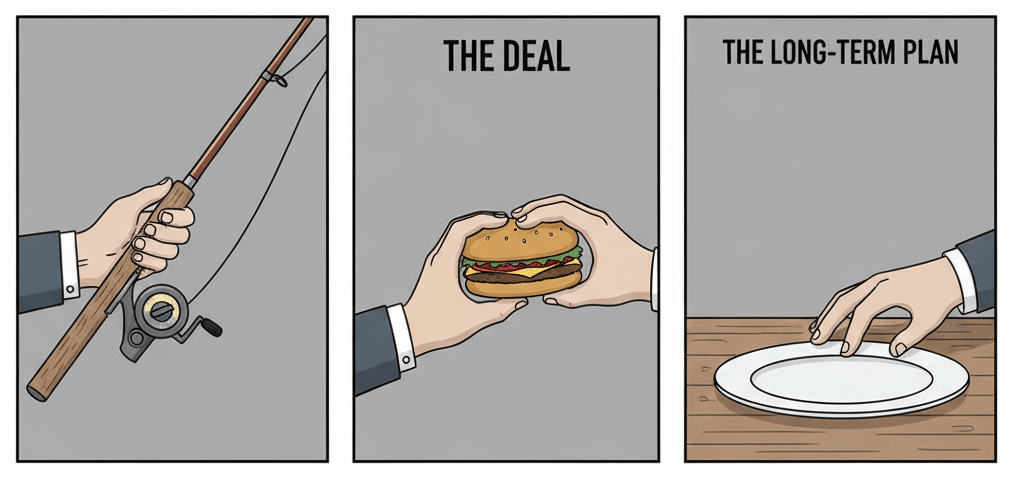

It’s like selling your fishing rod to buy a burger – sure, you’ll eat once, but then you’ll starve.

A £3 Billion Industry – and They Still Want More?

The Historic & Classic Vehicles Alliance (HCVA) – the not-for-profit organisation that represents Britain’s classic industry – reports that the sector has a total annual turnover of £18.3 billion, employing thousands in skilled trades and generating £2.9 billion in tax for the UK economy.

So if you already have a multi-billion-pound, tax-positive industry that also preserves British craftsmanship, exports culture, and attracts tourism… why on earth would you risk damaging it for an extra £100 million?

That’s not fiscal responsibility – that’s economic vandalism disguised as virtue.

The 40-Year Rule Wasn’t a Loophole – It Was a Thank You

The classic-car exemption was never meant as a free ride for millionaires polishing Ferraris.

It was created to recognise cultural value – a small “thank you” for preserving Britain’s motoring history.

Most classic-car owners aren’t oligarchs. They’re retirees, enthusiasts, and tinkerers with oily fingernails, juggling parts receipts and dreams in equal measure.

Reintroducing VED would force many to SORN (declare off-road) their vehicles permanently. And once those cars stop moving, so does the money – less driving, fewer shows, smaller events, empty workshops.

That £100 million “gain”? It’ll evaporate faster than a promise in a party manifesto.

The Sustainability Myth

Let’s get one thing straight: classic cars aren’t environmental villains.

According to the Federation of British Historic Vehicle Clubs, historic vehicles make up less than 0.2% of UK traffic and average only 1,200 miles a year. You’re telling me that’s a climate threat? That’s like banning candles to fight global warming.

In reality, classics are the ultimate circular-economy product – repaired, reused, restored, and still running.

Unlike new cars (or EVs) that can emit up to 40 tonnes of CO₂ before they even reach the showroom, a lovingly maintained MGB or Mini has already paid its carbon dues long ago.

So if anything, classic owners are accidental eco-warriors – keeping old stuff alive instead of buying new.

Britain’s Motoring Heritage – A Global Treasure

From Minis to E-Types, from Bentleys to Aston Martins, British motoring heritage is world-renowned. We export that culture globally – through films, shows, tourism, and events like Goodwood and the NEC Classic Motor Show.

Taxing that culture would be like charging the Queen for waving.

It’s not just about old cars – it’s about identity, craftsmanship, and pride. The sort of pride that built an industry now being chipped away by short-term thinking and political opportunism.

The Ripple Effect – and the Real Losers

If this policy goes through, the knock-on effects will be devastating:

- Restoration workshops will close.

- Apprentices will lose opportunities in traditional trades.

- Car shows and museums will shrink.

- International collectors will look elsewhere.

- Tourism linked to British motoring culture will suffer.

All for the sake of a headline that sounds tough but makes no long-term sense.

It’s performative penny-pinching – politics dressed up as pragmatism.

There’s a Better Way

If the government genuinely wanted to boost revenue, it should be investing in the classic-car industry, not punishing it.

Support British restoration exports, fund apprenticeships, promote heritage engineering.

Because this isn’t nostalgia – it’s business.

A vibrant, self-sustaining, £3-billion-tax-paying business.

The Optics Are Awful

After ULEZ, after whispers of pay-per-mile driving, after record fuel prices – the government already looks anti-motorist.

Does Labour really want headlines screaming “Rachel Reeves Taxes Heritage Cars”?

It’s not smart economics, and it’s certainly not smart politics.

Britain’s Classics – Our National Treasure

Classic cars represent freedom, creativity, and craftsmanship – the same spirit that put Britain on the motoring map.

They’re not relics of privilege; they’re rolling proof of human ingenuity.

To tax them is to charge admission to your own history.

Killing the Golden Goose

If this rumour is true, it’s the definition of short-termism.

Because when you tax passion, you kill it.

When you make preservation a penalty, people stop preserving.

And when you attack enthusiasts who already contribute billions, you’re not balancing the books – you’re cooking the goose that lays the golden eggs.

For what?

A quick snack of political optics – a goose burger served cold with a side of economic regret.

So, what do you think?

Is this talk of re-taxing classics utter madness or necessary evil?

Maybe it’s time for a petition – or better yet, a convoy of classics rumbling past Parliament to remind them what real heritage looks (and sounds) like.

Until then, keep driving, keep restoring, and keep reminding them: Britain’s car culture isn’t a luxury – it’s part of who we are.

If you found this useful, interesting or fun, consider supporting me via Patreon, Ko-Fi, or even grabbing a copy of one of my books on Amazon. Every bit helps me keep creating independent automotive content that actually helps people.

Support independent car journalism 🙏🏽☺️ grab my books on Amazon, take up membership to BrownCarGuy on YouTube, or join me on Ko-Fi or Patreon.

👉🏽 Channel membership: https://www.youtube.com/browncarguy/join

👉🏽 Buy me a Coffee! https://ko-fi.com/browncarguy

👉🏽 Patreon – https://www.patreon.com/BrownCarGuy

MY BOOKS ON AMAZON!

📖 Want to become an automotive journalist, content creator, or car influencer? Check out my book: How to be an Automotive Content Creator 👉🏽 https://amzn.eu/d/7VTs0ii

📖 Quantum Races – A collection of my best automotive sci-fi short stories! 👉🏽 https://amzn.eu/d/0Y93s9g

📖 The ULEZ Files – Debut novel – all-action thriller! 👉🏽 https://amzn.eu/d/d1GXZkO

Discover more from Brown Car Guy

Subscribe to get the latest posts sent to your email.