The £5,690 VED Shock, Modern Classics Trap & Why No Car Is Safe Anymore

From April 2026, the cost of owning a car in the UK shifts again. Not with a single dramatic ban or headline-grabbing announcement, but with a carefully calibrated set of Vehicle Excise Duty changes that, taken together, tell a very clear story. A story about who is being nudged. Who is being punished. And who, increasingly, is being priced out. In this piece, I’m going to walk you through every major UK road tax (VED) change coming in April 2026, using the actual Treasury tables, not speculation, not press-release gloss, and not the usual “this only affects rich people” dismissal. Because it doesn’t.

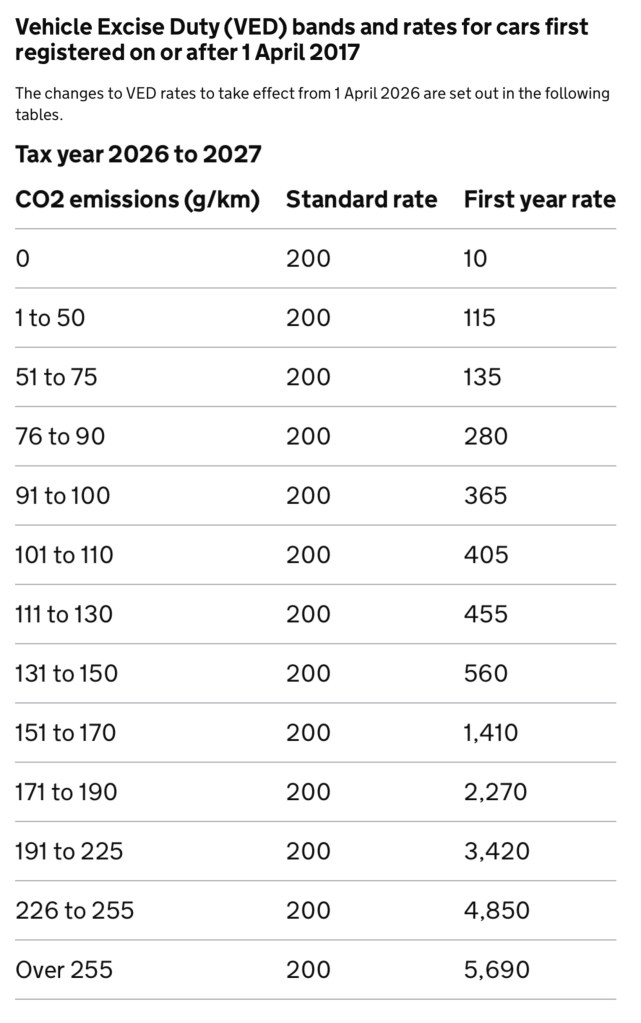

Let’s start with the figure that grabbed the headlines. From 1 April 2026, any new car registered after April 2017 that emits more than 255g/km of CO₂ will attract a first-year VED charge of £5,690. That’s not a typo. That’s nearly six thousand pounds, before insurance, before fuel, before you’ve even driven the thing home.

This represents another increase on top of what was already a brutal rise last year, and compared with just a couple of years ago, the top rate has effectively doubled.

According to HM Treasury’s own figures, around 60 cars now fall into this top band. Yes, that includes the usual suspects – supercars, luxury saloons, high-performance SUVs. Large family SUVs.

This matters because the logic behind first-year VED is no longer subtle. It’s no longer about gently steering consumer behaviour. It’s about front-loading the cost of ownership, making the act of buying new feel punitive. And that’s not an accident.

CORRECTION: Important clarification on double-cab pick-ups:

In the video I referenced these vehicles as being subject to the higher car VED bands. However, while double-cab pick-ups (Hilux, Ranger etc.) are being treated as cars for company car tax (BIK) from April 2025, they are still classed as light commercial vehicles for VED if they meet the 1-tonne payload rule.

So under the current April 2026 rules, they do not attract the car-based first-year £5,690 rate or the luxury car supplement.

The confusion is understandable given the recent reclassification and media coverage — but VED and BIK operate under different rules.

Appreciate those who flagged it!

The Forgiveness Phase: Why New Cars Suddenly Get a Pass

Here’s where the system becomes contradictory. Once that brutal first year is out of the way, the rules suddenly soften. For all cars registered after April 2017, regardless of emissions, the standard annual VED rate from year two onwards is £200.

That means a brand-new high-performance SUV emitting nearly 300g/km of CO₂ can, from year two onwards, be cheaper to tax annually than a much older, slower, lightly-used enthusiast car. In theory.

And then there’s the so-called Luxury Car Tax, officially known as the Expensive Car Supplement (ECS). From April 2026:

- The ECS rises from £425 to £440 per year

- It applies from year two to year six

- It is payable on top of the £200 standard rate

So if your car qualifies, you’re paying £640 per year for five years.

There is one important change worth noting. For electric cars registered after 1 April 2025, the ECS threshold rises from £40,000 to £50,000. Petrol and diesel cars, however, remain firmly stuck at £40,000.

This creates a strange dynamic. New cars are punished once, then forgiven. Older cars are not.

Modern Classics: The Worst Place to Be

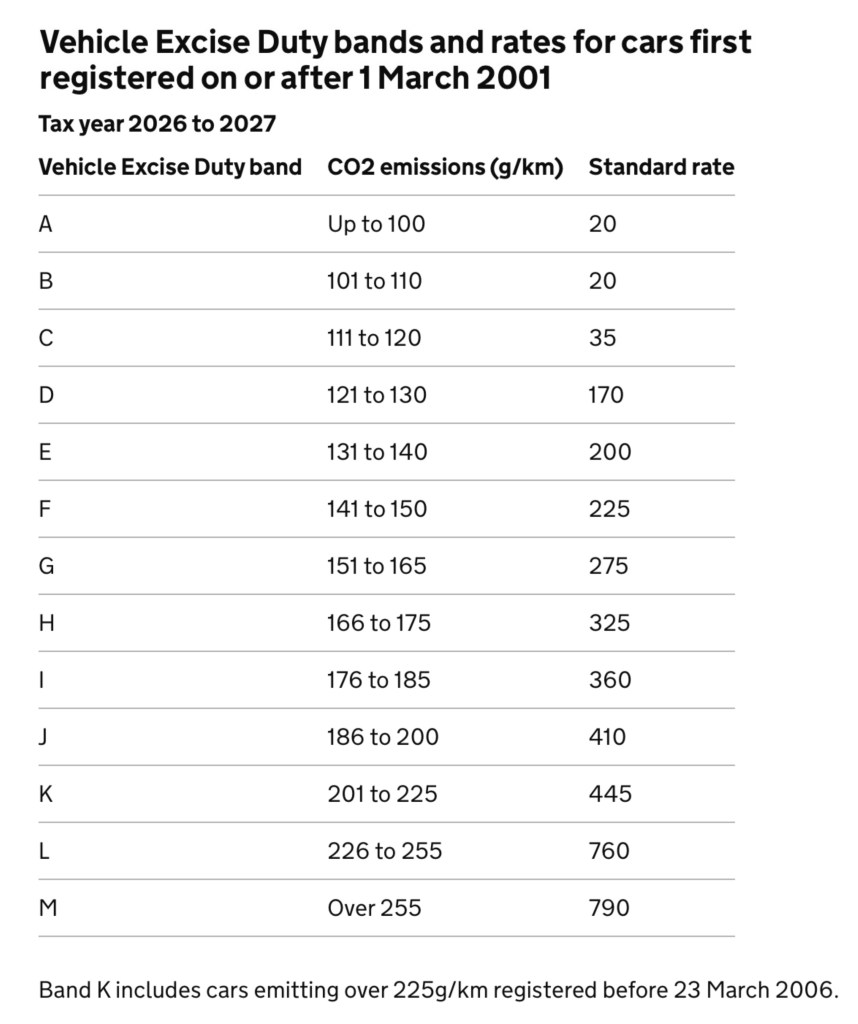

Now we get to the most quietly brutal part of the system. Cars registered between March 2001 and April 2017 – what many of us now call modern classics – sit under a completely different VED regime. One based purely on CO₂ emissions, from a time when nobody imagined those figures would still matter two decades later.

From April 2026:

- Band L (226–255g/km): £760 per year

- Band M (over 255g/km): £790 per year

Every year. And rising.

These are not daily commuters. These are weekend cars, hobby cars, enthusiast cars. Vehicles that might cover 2,000 miles a year, spend most of their lives garaged, polished, photographed and cherished.

- BMW E46 M3s.

- E39 M5s.

- Jaguar XKRs.

- Early AMGs and Audi RS models.

And yet these cars are treated more harshly than many brand-new vehicles. There is:

- no recognition of low mileage

- no reward for maintenance

- no acknowledgement that keeping an existing car alive is often greener than scrapping it

They simply sit in the worst possible tax window. Too new to benefit from historic status. Too old to enjoy the flat post-2017 rate.

“Fine, I’ll Just Buy Older”… Except That’s Closing Too

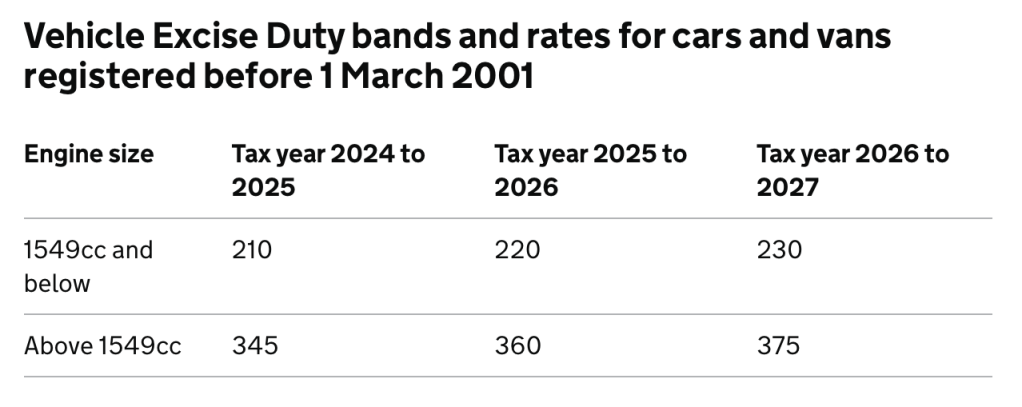

At this point, many motorists look further back.

Cars registered before 1 March 2001 are taxed purely on engine size. From April 2026:

- Up to 1549cc: £230

- Over 1549cc: £375

On their own, these numbers aren’t outrageous. But the direction of travel matters. Even the oldest, simplest system is creeping upwards.

The one genuine escape route remains the 40-year historic exemption, which removes both VED and MOT requirements on a rolling basis.

Why Used Buyers Still “Win”… For Now

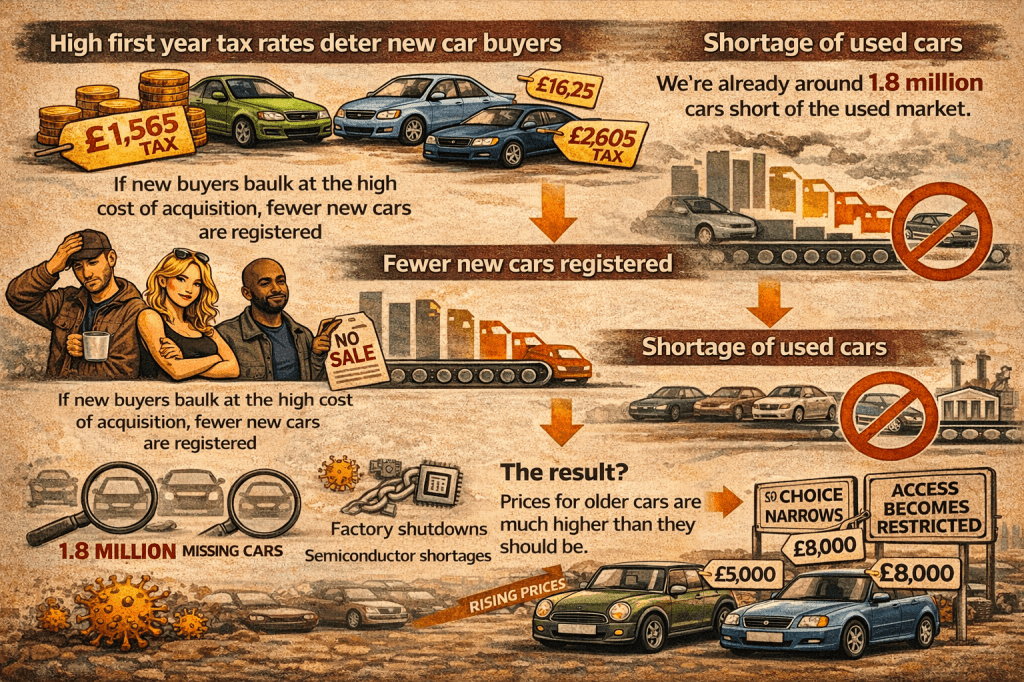

Used buyers still avoid the worst of the system. Someone else already paid the £5,690 hit. That’s why used performance and luxury cars still make sense on paper. But there’s a longer-term consequence that’s rarely discussed.

If fewer people register cars new, fewer cars enter the used market later. And that matters because the UK is already short of used cars. It’s estimated that around 1.8 million vehicles are missing from the market due to factory shutdowns and semiconductor shortages during and after the pandemic. The result is predictable:

- higher prices

- reduced choice

- restricted access

All without a single ban ever being announced.

What All of This Really Tells Us

So let’s recap. New cars are punished hard, once. Older cars are punished gently, repeatedly. No band ever goes down. No bill ever shrinks. This is fiscal creep, applied with patience and political cover.

And it doesn’t hit everyone equally. It hits:

- enthusiasts

- collectors

- people keeping cars longer

- drivers opting out of constant new-car churn

Ironically, often the people doing the least environmental damage.

April 2026 isn’t just about a £5,690 headline. It’s about a system that quietly punishes buying new, punishes keeping old, and rewards compliance without ever having to shout. And that’s the real story.

If you found this useful, interesting or fun, consider supporting me via Patreon, Ko-Fi, or even grabbing a copy of one of my books on Amazon. Every bit helps me keep creating independent automotive content that actually helps people.

Support independent car journalism 🙏🏽☺️ grab my books on Amazon, take up membership to BrownCarGuy on YouTube, or join me on Ko-Fi or Patreon.

👉🏽 Channel membership: https://www.youtube.com/browncarguy/join

👉🏽 Buy me a Coffee! https://ko-fi.com/browncarguy

👉🏽 Patreon – https://www.patreon.com/BrownCarGuy

MY BOOKS ON AMAZON!

📖 Want to become an automotive journalist, content creator, or car influencer? Check out my book: How to be an Automotive Content Creator 👉🏽 https://amzn.eu/d/7VTs0ii

📖 Quantum Races – A collection of my best automotive sci-fi short stories! 👉🏽 https://amzn.eu/d/0Y93s9g

📖 The ULEZ Files – Debut novel – all-action thriller! 👉🏽 https://amzn.eu/d/d1GXZkO

Discover more from Brown Car Guy

Subscribe to get the latest posts sent to your email.

Got an idea [ its probably been suggested before]: as an ‘easy fix’ for the many classics stuck away in garages for just the odd day out when the owner isnt using the train / bus / bike etc for their daily life – INTRODUCE DAILY VED charge . IE exactly the current system but all online including the refunds BUT by the day, not month. Then the weekend car or the car show car or whatever can be taxed for the 20 – 40 days a year when it is actually used. And if its £2 a day….well most owners will cope with that. Maybe DVLA / the politicians should be attacked to make that change rather than the actual £’s per category?

LikeLike