I’ve got all the rates for cars, EVs, vans and bikes

The cost of motoring in Britain just took a major hit. From the beginning of this month, 1st April 2025, road tax – or Vehicle Excise Duty (VED) to use the proper term – has undergone a serious shake-up, and it’s affecting everyone: petrol and diesel drivers, EV owners, motorcyclists, and van users alike. Basically you will ALL PAY MORE! But how much more?

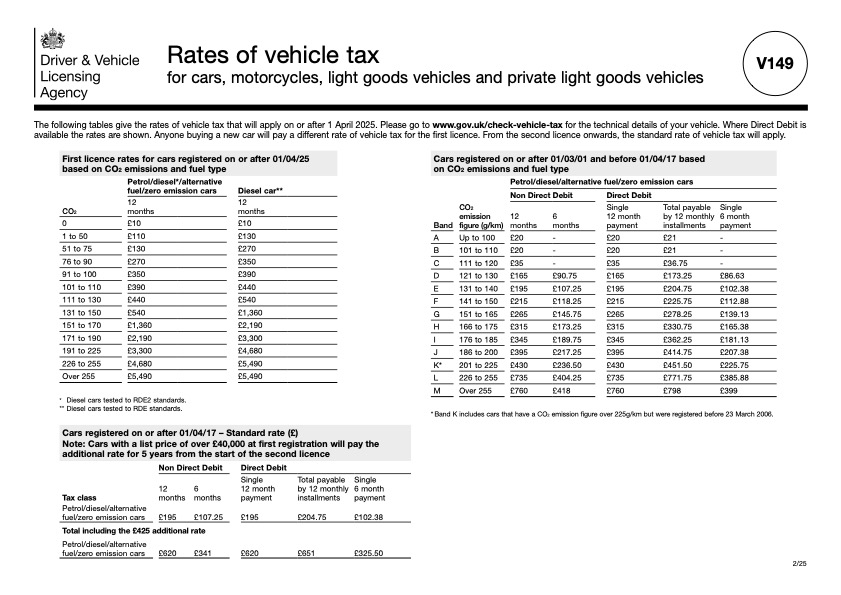

I’ve now got my hands on the official V149 rate tables for 2025, and compared them line-by-line with the 2024 version. And let me tell you, the results are pretty shocking. In this post, I’m going to break it all down for you so you know exactly how much more you’ll be paying. Whether you’re buying a new car, running an old banger, or just trying to stay on top of your bills, this is essential info.

What’s Actually Changed?

One of the first things that jumps out from the new 2025 V149 document is that the Alternative Fuel category has been scrapped entirely. No more slightly cheaper rates for hybrid or LPG vehicles – everything is now bundled into general CO₂-based emissions bands. That means whether you’re running petrol, diesel, or anything else, the key factor is how many grams of CO₂ per kilometre your vehicle emits.

But the biggest change – and the one that’ll hit most drivers hardest – is the massive increase in the first-year tax for newly registered cars. I’m talking 100%, even 200% hikes in some bands. It’s especially brutal for high-emission SUVs and sports cars – the kind many families and enthusiasts favour – where rates now soar into the thousands of pounds.

First-Year Tax – The Shocking Bit

Let’s say you’re planning to buy a new car in 2025. That first-year tax is based on CO₂ emissions, and it’s now eye-wateringly high. For example, a brand-new car emitting over 255g/km will now attract a whopping £5,490 in first-year tax alone. That’s nearly double last year’s rate of £2,745. And here’s the kicker – even electric vehicles are no longer exempt. A zero-emission car will now cost you £10 in VED, where it previously cost nothing.

This isn’t a subtle adjustment. A car in the 91–100g/km range, for example, jumps from £175 to £350. A 150g/km car? From £270 to £540. These are numbers that will force people to think twice about what they’re buying – and that’s likely the point. Whether it’s about revenue or pushing people toward greener options, the result is the same: higher bills.

Standard Annual Rates – No Escape Here Either

Once your new car is past its first year, you start paying the standard annual rate. That’s also gone up. In 2024, it was £190 for petrol and diesel, and £180 for alternative fuels. Now it’s a flat £195 – no discounts, no exceptions.

And if your car cost over £40,000 when new, don’t forget you’ll also pay the luxury car surcharge, which has crept up from £410 to £425 per year, for five years. So that’s £195 plus £425 – a total of £620 a year for half a decade. Ouch.

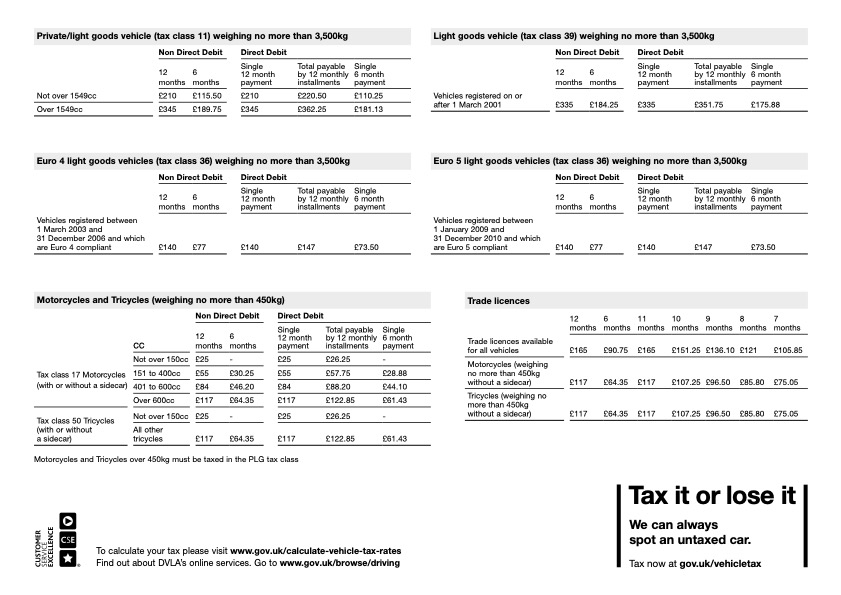

Older Cars (2001–2017) – Still Rising

If you’re running a vehicle registered between 1 March 2001 and 1 April 2017, you’re still in the old CO₂ banding system – A through to M – and you’ll still feel the squeeze.

Some of the lower bands haven’t changed much. In fact, band B (101–110g/km) and band C (111–120g/km) remain the same at £20 and £35 respectively. But everywhere else, there are bumps. Most rates go up by £5 to £15 depending on the band, with the highest category (over 255g/km) now costing £760 per year – up from £735.

Weirdly, that means someone driving a thirsty old V8 from 2006 could be paying more in annual road tax alone than a new high-performance muscle car. Make of that what you will.

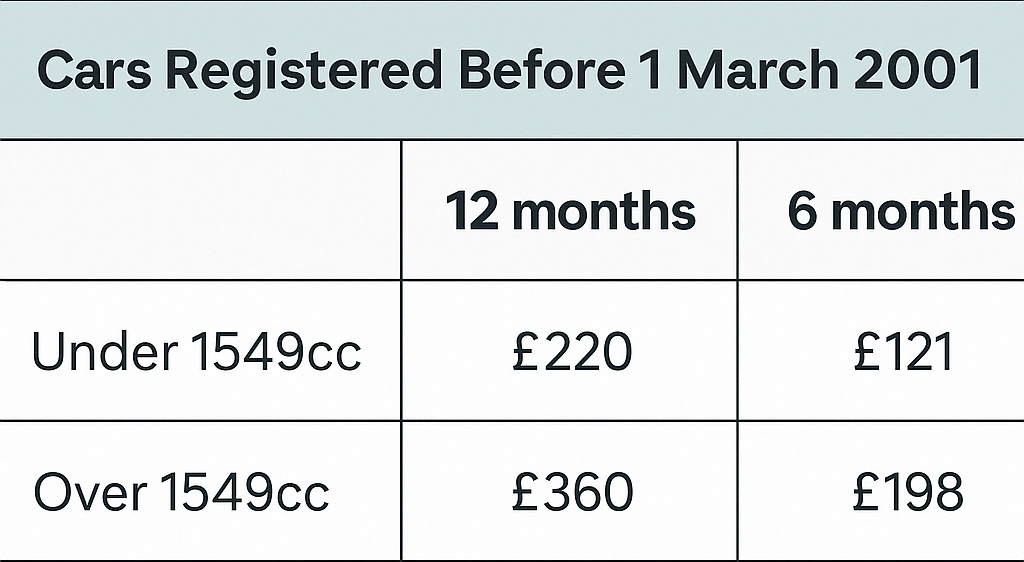

Cars Older Than 2001 – Still Hanging On?

Now if you’re a proper old-school motorist running something pre-2001, you’re in the engine-size-based banding – under or over 1549cc. These haven’t escaped either. Rates for these cars have also been bumped up by £10–15, which might not sound much, but it’s consistent with the theme: everyone pays more in 2025.

What About Bikes, Vans, and Commercials?

Yep, they’re hit too.

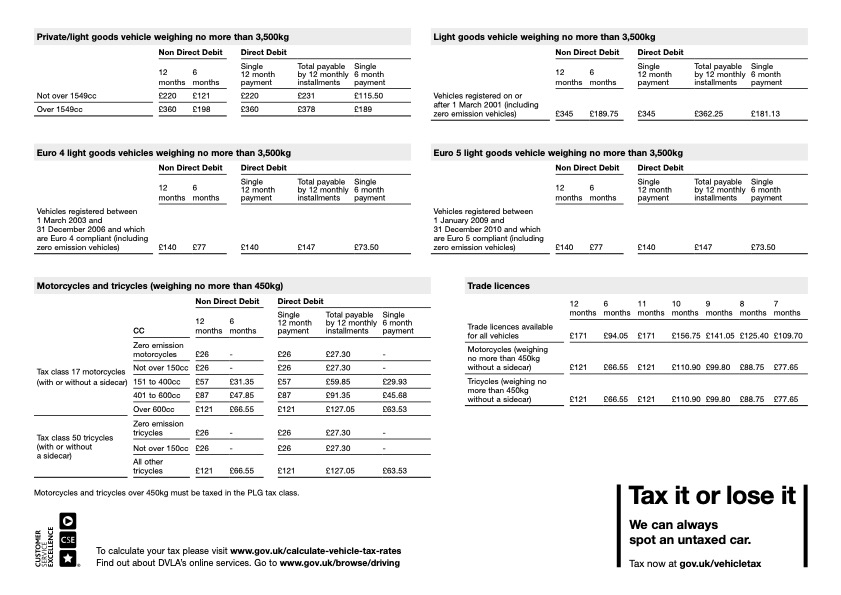

Private Light Goods Vehicles – basically everyday vans – now face higher annual tax, especially those over 1549cc. Light Goods Vehicles (tax class 39) registered after 2001 have gone from £335 to £345 a year. Not the end of the world, but it adds up, especially for fleets.

Even motorcycles haven’t been spared. Across the board, there are small increases for each engine size band. And perhaps most surprisingly, zero-emission motorcycles, which were previously tax-exempt, now face a flat £26 a year. So much for going green and saving money, eh?

Trade Plates and Special Licences

Even trade licence fees are up, rising by a few quid depending on the category. It’s minor in comparison to the rest, but again, part of the general upward trend.

What Does It All Mean?

In short? The era of “cheap motoring” is well and truly over. Whether you’re buying new, maintaining an older car, or running a small business with vans, the government wants more out of your wallet – and they’re not being subtle about it.

Yes, there’s an environmental angle. And yes, encouraging a shift away from high-polluting vehicles is a good thing. But the way this has been done – with across-the-board hikes, minimal public awareness, and a quiet deletion of the alternative fuel category – smacks of a tax grab more than a green revolution.

Want to Know More?

I’ve included both the 2024 (below) and 2025 (above) V149 rate tables below for you to download. Make sure you check your car’s emissions or registration year and see exactly where you stand.

And if you’ve got questions – or want to rant about your new tax bill – leave a comment below or message me on socials.

Follow all my channels https://linktr.ee/browncarguy

Get my books! https://amzn.eu/d/9fwhSoQ | https://amzn.eu/d/9IHhqXA

Sponsor my content from as little as £3 at https://ko-fi.com/browncarguy

Big Thanks to my Supporters!

Tom Conway-Gordon (https://www.instagram.com/anycoloursolongasits_black/)

And others! 🙏🏽☺️

Discover more from Brown Car Guy

Subscribe to get the latest posts sent to your email.

Leave a comment